The Illinois Legacy Challenge

In honor of the With Illinois campaign, a generous alumnus has donated $1,000,000 in matching funds to create the Illinois Legacy Challenge.

How it Works

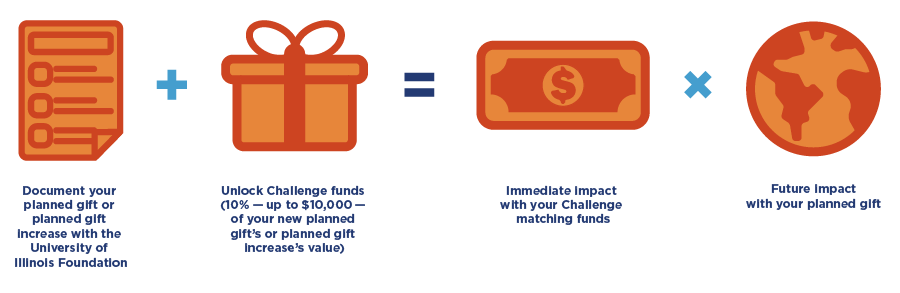

In honor of the With Illinois campaign, a generous alumnus has donated $1,000,000 in matching funds to create the Illinois Legacy Challenge. If you document a new planned gift with the University of Illinois Foundation (“UIF”) benefitting any Illinois purpose or an increase to your existing planned gift on record with UIF benefitting any Illinois purpose, you will have the ability to tap the matching pool to direct 10% (up to $10,000) of your new or additional planned gift’s value to immediately benefit one of these funds:

- Illinois Commitment Scholarship Fund (#342186)

- UIUC Chancellor’s Fund (#330007)

- Diversity, Equity, and Inclusion Support Fund (#336761)

- University of Illinois Urbana-Champaign Health Sciences Priority Fund (#335855)

- The College or Unit Unrestricted Fund of Your Choice

How to Participate

There are four ways you can take part in the Illinois Legacy Challenge:

- Name UIF for the benefit of your preferred Illinois purpose in your will or living trust. A bequest through your will or living trust is a simple option, and UIF can provide you with recommended language to best fit the impact you’d like to make.

- Designate UIF for the benefit of your preferred Illinois purpose as a beneficiary of your retirement plan or transferable/payable on death (“COD”/”POD”) account. These gifts can be finalized in one day and, as with bequests, UIF can provide you with the designation language to best fit the impact you’d like to make.

- Establish a life-income gift with UIF for the benefit of your preferred Illinois purpose. Life-income gifts, like charitable gift annuities or charitable remainder trusts, are options that can provide you or up to two loved ones with lifetime payment streams while ultimately supporting Illinois. UIF can provide you with a custom, no-obligation illustration for these gift options and help you determine the choice that might best meet your financial objectives.

- Increase Your Existing Planned Gift on Record with UIF. Every dollar increase in your existing planned gift is a dollar that qualifies for the Challenge’s matching structure.

Yes, I’d like to Learn More About the University of Illinois Legacy Challenge!

Ready to join the Illinois Legacy Challenge? Get started by clicking the button below.

Additional Details

The Challenge begins on October 15, 2021, and will continue until the matching pool has been extinguished or June 30, 2022, whichever comes first. Planned gifts of life insurance are not eligible to participate in the Challenge. Beneficiary designation and bequest donors must be at least age 65 by June 30, 2022, to have their gifts qualify for Challenge matching funds. Challenge matching dollars are pure charitable gifts and do not give the qualifying planned gift donor any ticket benefits.

Contact

University of Illinois Foundation

Office of Gift Planning and Trust Services

1305 West Green Street, MC 386

Urbana, IL 61801

217.244.0473

gpinfo@uif.uillinois.edu

FAQ

Q: If I have already documented a planned gift with UIF, will it qualify for the Illinois Legacy Challenge?

A: Generally speaking, the Challenge is meant to encourage the creation of new planned gifts or to inform UIF about previously-established but unreported planned gifts. However, if you have increased the amount of a previously documented planned gift with UIF then we will credit that increased value to participate in the Challenge.

Q: Can I direct Illinois Legacy Challenge matching funds to benefit a different College or Unit at Illinois than where my planned gift is directed?

A: Absolutely! The matching funds can be directed to the UIUC College or Unit unrestricted fund of your choice, and they do not need to follow the same designation as your planned gift.

Q: What if the value of my new planned gift or planned gift increase exceeds $100,000 — will I qualify for more than $10,000 in matching funds?

A: Per our agreement with the Challenge’s matching pool donor, there is a cap of $10,000 on matching funds per planned gift. As one of the Challenge’s goals is to involve as many Illinois planned gift donors as possible, we are looking to avoid expending the matching pool on a small number of large planned gifts.

Q: Can I direct my planned gift’s matching Challenge funds to my named fund, to help create a new endowed fund, or across the funds listed?

A: No – each qualifying planned gift donor must direct the entirety of their matching Challenge funds to one of the qualifying funds listed above.

Q: Who made the Illinois Legacy Challenge possible?

A: The Challenge has been made possible by the tremendous generosity of an anonymous Illinois alumnus.